How RBC is Leading the Charge with AI Technology

As Canada’s largest bank, Royal Bank of Canada (RBC) has embraced technology to redefine its operations and enhance its services. With an expansive reach across 29 countries and a workforce of over 98,000, RBC has positioned itself as a leader in integrating Artificial Intelligence (AI) into its business model. An impressive $5 billion investment has been committed to technology, reflecting RBC’s vision of creating substantial value through AI. This ambitious target aims to generate between $700 million and $1 billion in enterprise value by the year 2027.

Responding to Evolving Risks with Machine Learning

The application of machine learning at RBC is primarily focused on adapting to rapidly evolving fraud risks. The alarming rise in AI-enhanced scams—as highlighted by the Ontario Securities Commission—has prompted RBC to modernize its fraud detection systems. With Canadians losing $638 million to fraud in 2024, RBC is not just reacting but innovating, using advanced systems that leverage real-time risk scoring powered by AI and machine learning. This allows RBC to analyze an astounding volume of security events—approximately 11 trillion in 2024—thereby enhancing its capability to predict and prevent fraud.

Deep Learning for Optimized Pricing

In addition to fraud detection, RBC employs deep reinforcement learning to optimize pricing strategies across trading activities. This approach offers traders greater control and enables them to minimize slippage against established industry benchmarks. By harnessing sophisticated algorithms, RBC ensures that its trading operations are not only competitive but also responsive to market fluctuations.

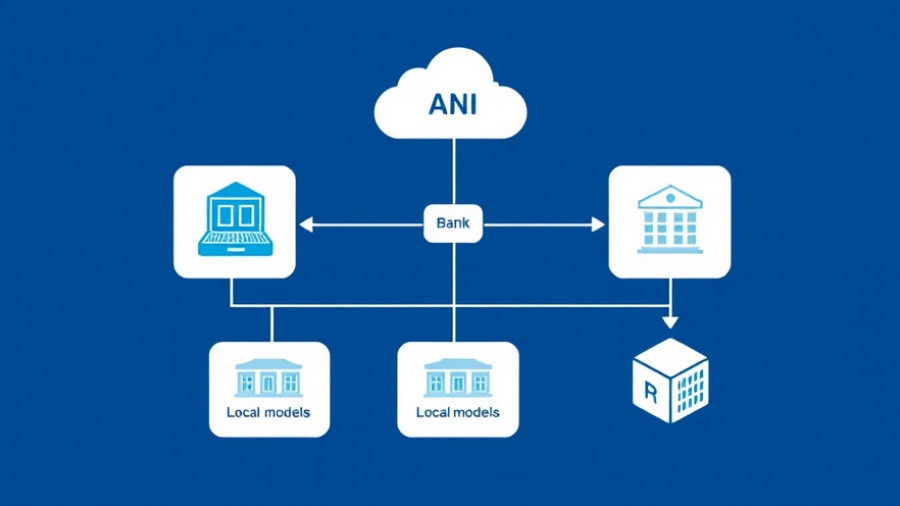

Collaborative Innovation at RBC Borealis

The formation of RBC Borealis, the bank's AI research institute, is a testament to its commitment to continuous improvement and innovation. Functioning as the default center of excellence for AI within the bank since 2016, RBC Borealis focuses on both fundamental and applied research in the domain of machine learning. With over 950 dedicated professionals, the institute aims to advance AI applications not just within financial services but across various sectors.

The Future of Banking with AI

As RBC continues to make significant strides in AI technology, the future of banking appears to be increasingly intertwined with advancements in digital innovation. The bank's efforts in modernizing fraud detection and optimizing trading systems provide a roadmap for other financial institutions looking to navigate the evolving challenges posed by technology. RBC’s future engagement in AI could redefine not only its operational capabilities but also set a precedent within the banking industry.

Actionable Insights for Business Owners

For business owners, the advancements at RBC serve as a crucial reminder of the importance of integrating AI into operations. Investing in technology that enhances efficiency and security can yield significant benefits—ultimately fostering trust with clients and stakeholders. This can be particularly beneficial in mitigating risks in financial transactions.

As the conversation around AI in podcasting and AI thought leadership grows, organizations must recognize the value of incorporating technology into their business models. Discussions around AI for creators and digital influence AI will continue to evolve, reshaping how companies operate in a digital-first world.

Add Row

Add Row  Add

Add

Write A Comment